salt tax deduction california

Rosenthal JD and Krista Schipp CPA. California does allow deductions for your real estate tax and vehicle license fees.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Starting with the 2018 tax year the maximum SALT deduction available was 10000.

. Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. Lawmakers finished fast action. The other sections of AB 150 are not covered in this article and include permanently extending the sales tax.

By Corey L. There would be no break or a minimal one for lower income taxpayers. High income tax rate.

According to the Tax Foundation the. Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. State and local taxes.

California became one of the 19 states and counting that has enacted its own pass-through entity PTE tax election statute as a workaround to the federal 10000 limitation on the state tax deduction the SALT deduction cap when it enacted AB. California does not allow a deduction of state and local income taxes on your state return. California is poised to restore corporate tax breaks and extend the states workaround for the federal cap on deductions for state and local taxes.

This is due to the states. 21-82 California has joined 16 other states that have now enacted an elective passthrough entity PTE tax. Since the passing of the TCJA you can only deduct 10000 effectively losing a deduction 12000.

Part 104 of the California Assembly Bill No. Enacted by the Tax. Note that only the Small Business Relief Act Part 104 of AB 150 addresses the SALT workaround.

113 signed by Governor Gavin Newsom makes several important tax changes including expanding the availability and benefit of the states pass-through entity PTE tax credit with most provisions taking effect during the 2021 tax year. 150 on July 16 2021. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. California joined the growing list of states to create a workaround of the 10000 cap on the federal deduction for state and local taxes paid for pass-through entities under a bill signed Friday by the governor. Like other SALT workarounds Californias.

California Enacts SALT Workaround. With the enactment of AB 150 Ch. The Tax Cuts and Jobs Act passed in 2017 limits an individuals annual federal deduction for SALT paid to 10000 for tax years 2018 through 2025.

Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction. Californias average SALT bill is the third-highest in the US. California recently passed a bill AB 150 which allows small business S-Corp and Partnerships to elect to deduct the state tax at the company level.

Gavin Newsom a Democrat signed AB. The California SALT deduction workaround passed July 16th 2021 with the California Budget and will be effective from 2021 to 2025. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE tax. Adding the 10000 cap increases the payment of an average California taxpayer who previously took the full SALT deduction by about 4000 according to a statement against the changes by several. While AB-150s elective tax work-around appears quite favorable to California residents the devil is always in the details which we address below.

These taxes may be used by passthrough entity owners as a workaround to the 10000 SALT deduction limitation enacted by the TCJA. How long is the SALT deduction in effect. Along with other provisions AB 150 allows certain owners of pass-through entities a way to deduct more than.

52 rows The SALT deduction is only available if you itemize your deductions. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which is Californias solution to the SALT limitation.

150 AB 150 passed on July 16 2021 is Californias answer to the SALT-cap deduction. Under AB-150 effective for tax years beginning January 1 2021 a Qualified Entity can elect annually to pay California income tax on behalf of its owners at a rate of 93 on its California. Unfortunately that legislation currently includes a limitation on the use of.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. If you want to take advantage of the workaround for the 2021 tax year you must take action by. 150 part of a package to enact Californias 2021-22 budget.

Effective for tax years 2021-2025 the Small Business Relief Act. Almost 70 of those earning 151100 to 358700 could benefit and those who do could see a tax 3750 savings. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers.

Tax legislation SB. Reinstating the net operating loss NOL deduction without limit for tax years beginning on or after January 1. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits.

Thankfully the IRS gave its stamp of approval to these type of. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA.

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

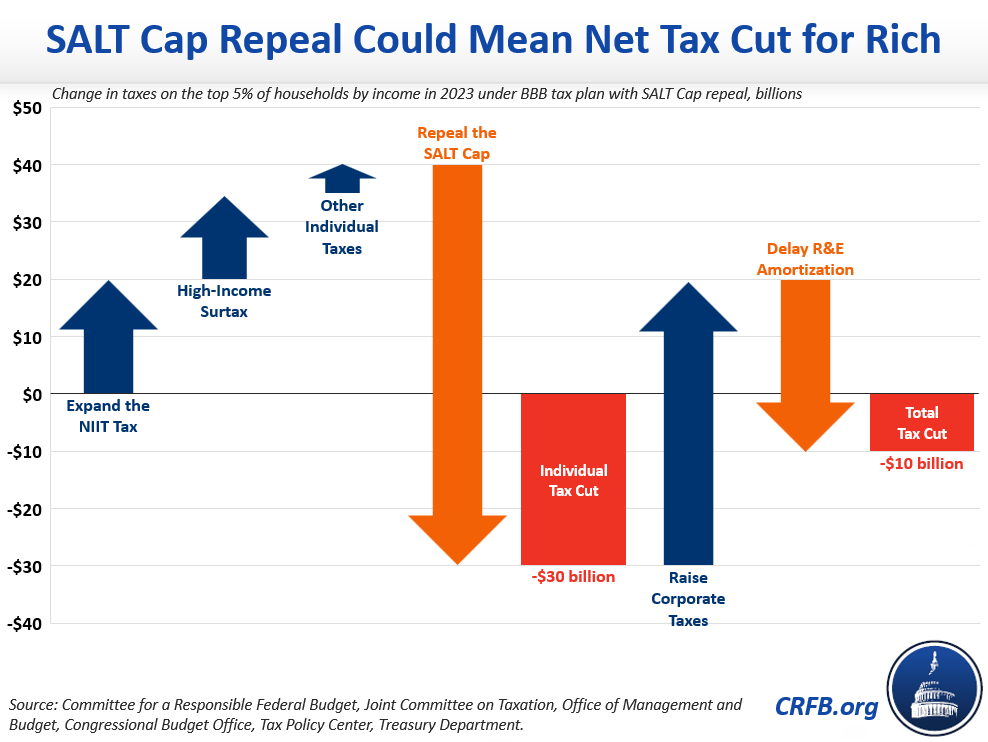

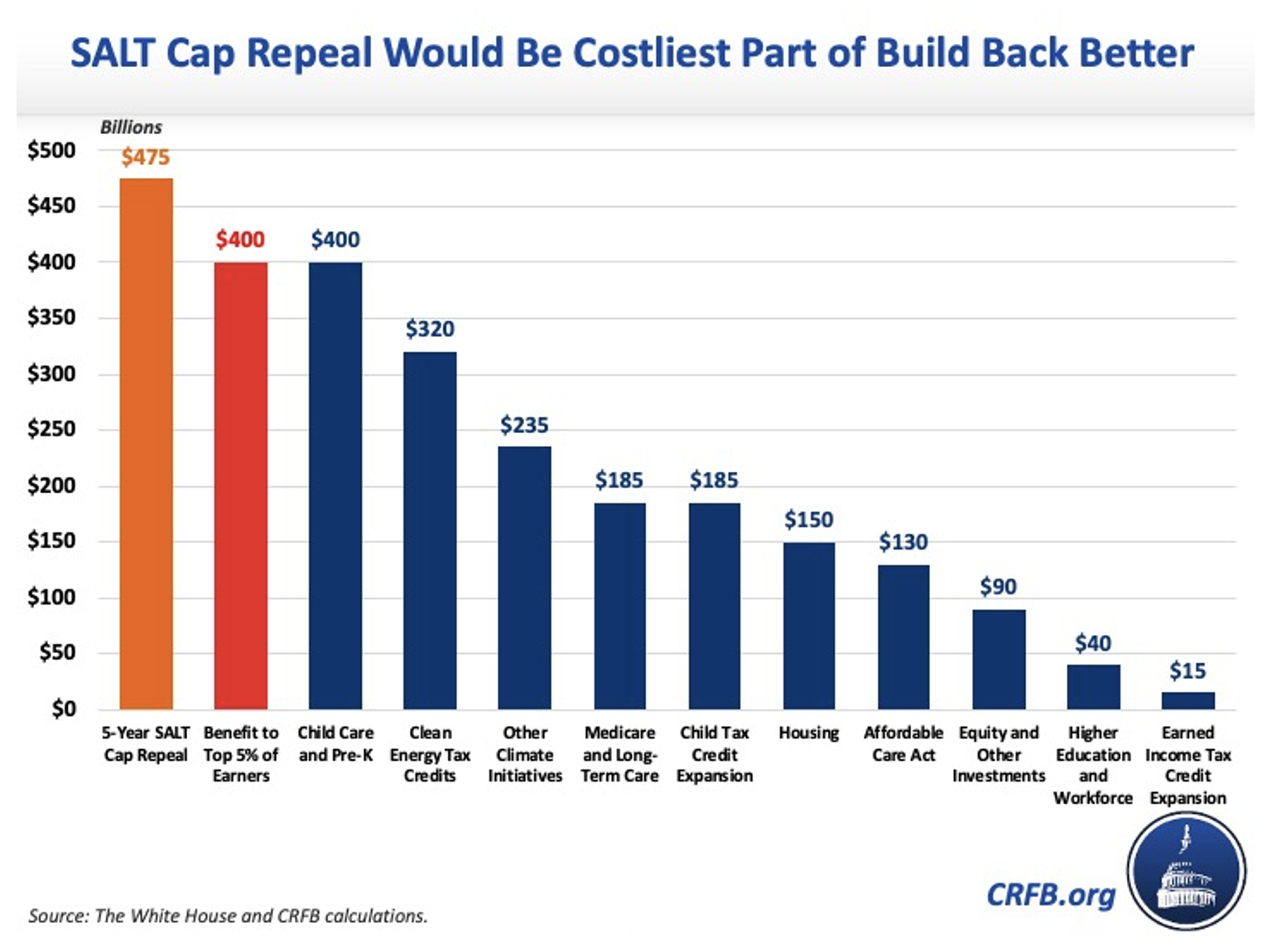

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

How To Win Your Personal Injury Claim Personal Injury Claims Injury Claims Mesothelioma

5 Tax Deductions Entrepreneurs Need To Know Business Blog Money Blogging Blog Tips

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

Photo By Jason Chen Unsplash Taiwan Travel Singapore Travel Taipei

State Tax Deduction Workaround Capata Cpa

Keep Calm Inspiration Calm Keep Calm Photography Love Quotes

This Bill Could Give You A 60 000 Tax Deduction

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union